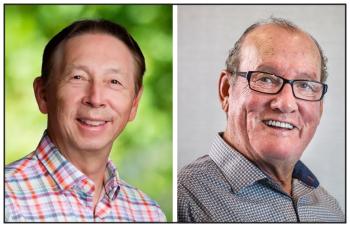

Image Caption

Local Journalism Initiative Reporter

Windspeaker.com

Additional financing announced today by the First Nations Finance Authority (FNFA) has allowed the seven-member Newfoundland and Nova Scotia Mi’kmaw coalition to refinance its Clearwater Seafood loan.

In 2020, FNFA made it possible for the coalition to purchase a 50 per cent share and $500 million stake in the seafood company by providing a $250 million loan. The other $250 million came as a sub-debt from the Mi’kmaw coalition’s partner in the purchase, Premium Brands of British Columbia.

It was the single largest investment in the seafood industry by any Indigenous group in Canada.

Now, said Membertou First Nation Chief Terry Paul, that sub-debt has been decreased by $100 million with more loan dollars from FNFA.

“We were able to negotiate…(the) buy down of the sub-debt, which in turn helps us get the cash flow to the community from the company a lot sooner, and that cash flow is going through all the seven coalition members,” said Paul.

While he wouldn’t say what cash flow the other Nations will be experiencing, he did say that Membertou would be receiving about $3 million annually in “free cash flow.”

“Imagine, we having the largest holdings of shellfish licenses and quotas in Canadian fisheries. For us, this is a remarkable example of economic reconciliation,” said Paul.

Paul joined FNFA president and CEO Ernie Daniels today to make the announcement that with FNFA’s 10th debenture, the Mi’kmaw coalition’s seven members were among the 25 First Nations across Canada to access $356 million to meet community priorities. The debenture provides unsecured loan certificates to First Nations governments.

The money will be used for projects including on-reserve housing in Cook’s Ferry, B.C.; construction of a grocery store in Glooscap, N.S.; and wastewater treatment plant upgrade in Mississaugas of Scugog Island in Ontario.

As of today, said Daniels, the FNFA has surpassed a $2 billion milestone in financing First Nations governments.

“This milestone is the first for a First Nation-led institution in Canada,” he said.

Daniels noted that FNFA is self-sufficient and does not rely on external funding.

Because FNFA can lend to its members at a rate of 4.28 per cent, which is 2.92 per cent below the bank’s prime rate, First Nations members can afford to build critical infrastructure both on and off-reserve, he said.

FNFA’s first debenture was made in 2014 and since then has resulted in nearly 20,000 jobs being created, said Daniels.

In June 2023, legislative amendments to the First Nations Fiscal Management Act (FNFMA), enabled the FNFA to extend its borrowing membership opportunities.

The FNFMA also created the First Nations Financial Management Board and the First Nations Tax Commission.

It is optional for a First Nation to work under the FNFMA and it must make the request to the Crown-Indigenous Relations minister.

Before a First Nation can become an FNFA borrowing member, it must work with the Financial Management Board, which assists it in developing capacity to meet financial management requirements.

“The process with our sister organization, the Financial Management Board, that process is a timely process, but it can be done quickly. It depends on the capacity of the First Nation,” said Daniels.

Presently 356 First Nations, more than half of the First Nations in Canada, are scheduled to the FNFMA, with 167 having completed the process to become a borrowing member.

Daniels said the federal government could help decrease the infrastructure gap compared to non-Indigenous communities which sits at $350 billion if Ottawa allowed revenues to be leveraged over a longer period of time.

Right now, he said, the government allocates a “certain amount each year and it’s never enough to close the gap so the gap is widening all the time.”

Daniels said FNFA has introduced the concept of monetization.

“This is monetizing federal government transfers like a house mortgage so you can build more today at today's cost and pay it off over time,” said Daniels.

Support from both the FNFA and Premium Brands, said Paul, is having an impact on the ground for the Mi’kmaw coalition.

“(It) is providing jobs and a much better quality of life for our communities and our children for generations to come,” he said.

Support Independent Journalism. SUPPORT US!